Monday the US reinstated a 25% tariff on steel imports and increased tariffs on aluminum imports to 25% from 10%. Here is the breakdown that impacts purchase price:

· The U.S. imported around 26 million metric tons of steel in 2024

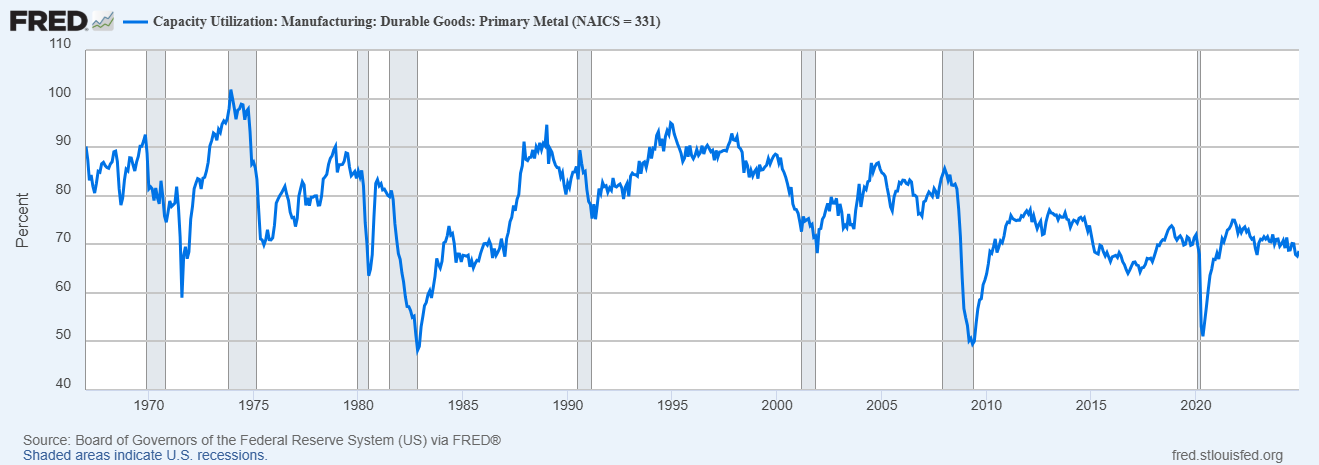

· 80.5 million tons produced of steel la year 76% utilization rate

· Based on just capacity, the US can produce an additional 4 to 5 million tons without price pressures.

· That’s a far cry short of 26 million so expect prices to increase.

· The U.S. imported around 5.43 million metric tons of aluminum in 2024

· The US capacity is about 800,000 metric tons per year

· U.S. primary aluminum production decreased by 30 percent from 2020 to 2024, and U.S. smelter capacity utilization was only 52 percent in 2024.

· Even if the US could bring aluminum capacity back online and double capacity, which is not likely, we are still several million pounds short.

In summary, there will be unfavorable purchase price variance. However, Tariffs do not go into effect until Mar 12, 2025 and it wouldn’t surprise me if they are decreased or eliminated.

For now, push back hard on all increases in watch what happens Mar 12, 2025.

Push back on all increases. To read a short written process on how to push back on supplier price increases, check out this K2 Sourcing blog post. https://www.k2sourcing.com/10-steps-for-negotiating-procurement-cost-avoidance.php

If you like this information, follow us on LinkedIn: K2 Sourcing LinkedIn page